When a drug hits the market, the clock starts ticking on its monopoly. The primary patent, which protects the active chemical ingredient, typically lasts 20 years from filing. But by the time the drug clears clinical trials and gets FDA approval, half that time is often gone. That’s where secondary patents come in - not to invent something new, but to stretch out the monopoly long after the original patent expires.

What Exactly Are Secondary Patents?

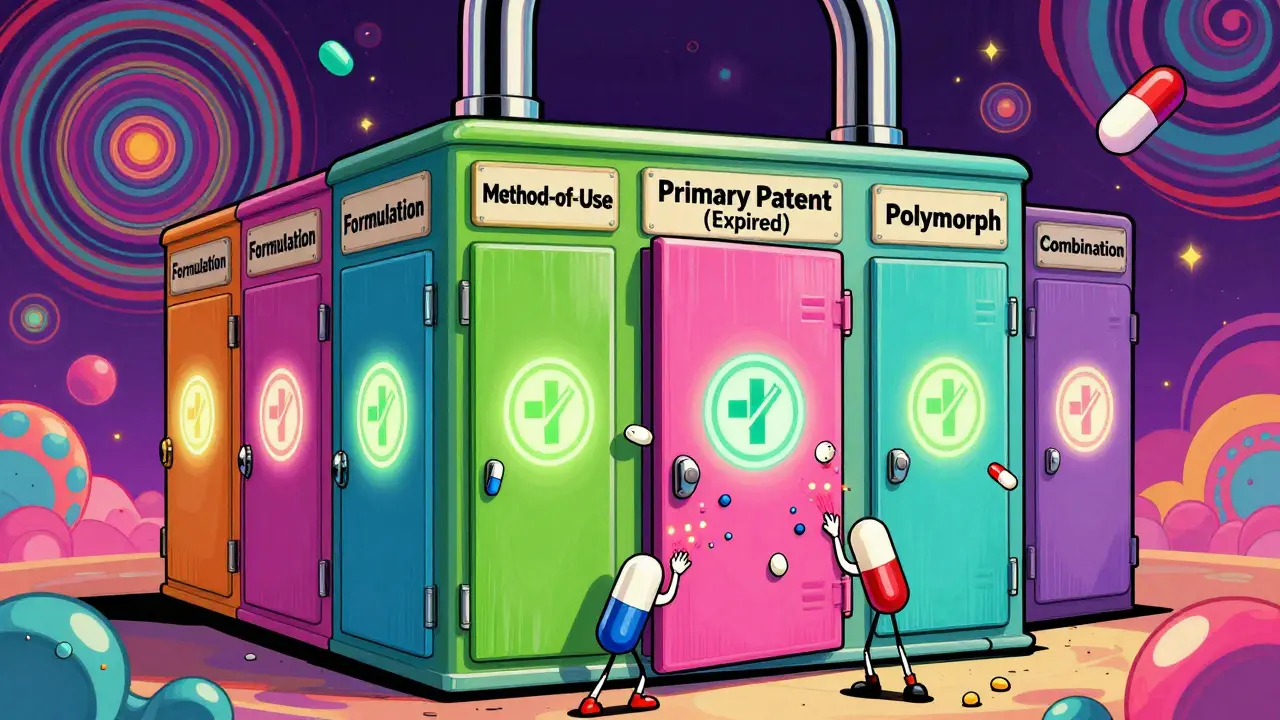

Secondary patents aren’t about the drug’s core molecule. They cover everything else: how it’s made, how it’s taken, what form it’s in, or even what disease it treats. Think of them as legal side doors. While the main door (the primary patent) is locked, these side doors stay open - keeping generics out even when the original protection runs out.There are 12 common types. Some examples:

- Formulation patents: Protecting a new pill coating that releases the drug slowly over 12 hours instead of 4. AstraZeneca used this with Nexium, switching from Prilosec (a mix of two mirror-image molecules) to just the more effective one - esomeprazole - and extending exclusivity by nearly a decade.

- Method-of-use patents: Claiming a new disease the drug can treat. Thalidomide was originally a sleep aid. Decades later, it got a new patent for treating leprosy, then another for multiple myeloma. Each one reset the clock.

- Polymorph patents: Protecting a different crystal structure of the same molecule. GlaxoSmithKline’s Paxil had its main patent expire in 2001, but a specific crystal form (Form G) was patented later, blocking generics until 2005.

- Combination patents: Protecting the drug when paired with another. Humira’s maker, AbbVie, filed over 260 secondary patents, many covering combinations with other drugs, keeping prices sky-high until 2023.

Some companies pile on more than 100 secondary patents for a single drug. Drug Patent Watch found that top-selling drugs often have 10 to 100+ patents layered on top of each other - creating what experts call a “patent thicket.” It’s not innovation; it’s a legal maze.

How Do They Delay Generic Drugs?

Generic companies can’t enter the market until all listed patents expire. The FDA keeps a public list called the Orange Book that includes patents the brand company says cover its drug. But here’s the trick: companies don’t list every patent. They strategically pick the ones most likely to scare off generics.When a generic maker files to sell a copy, they must challenge any listed patents by filing a “Paragraph IV certification.” This is basically saying, “Your patent is invalid or we don’t infringe.” But it’s expensive. Legal fights cost $15-20 million per drug. And even if the generic wins, the brand company can still sue, dragging out the process for years.

According to a 2019 Health Affairs study, drugs with secondary patents face generic entry delays that are 2.3 years longer than those without. For Humira, that meant 7 extra years of exclusivity after the primary patent expired. During that time, the drug cost $20 billion annually - money that could’ve been saved if generics had entered earlier.

Who Benefits? Who Pays?

The pharmaceutical industry argues secondary patents drive innovation. PhRMA says they lead to better dosing, fewer side effects, and new uses for rare diseases. There’s truth to that - some improvements matter. A 2021 American Cancer Society report found that new formulations of chemo drugs reduced severe side effects by 37% in trials.But most secondary patents don’t deliver real clinical benefits. Harvard’s Dr. Aaron Kesselheim reviewed hundreds of cases and found only 12% involved meaningful improvements. The rest? Minor tweaks - changing a pill color, switching from a capsule to a tablet, or slightly altering release timing. These don’t help patients. They just keep prices high.

Patients pay the price. Pharmacy benefit managers like Express Scripts say secondary patents raise their costs by 8.3% every year. Doctors report “product hopping” - where companies quietly push doctors to switch patients to the new, patented version just before generics arrive. Patients get confused. They’re told the new version is “better,” even if it’s the same drug in a slightly different wrapper.

Global Differences: Not All Countries Play by the Same Rules

The U.S. is the most permissive. Thanks to the Hatch-Waxman Act of 1984, companies have wide leeway to file secondary patents. But other countries draw the line.India’s patent law, Section 3(d), says you can’t patent a new form of a known drug unless it shows significantly better effectiveness. That’s why Novartis lost its bid to patent a new crystal form of Gleevec in 2013. India allows generics to enter early, making life-saving drugs affordable for millions.

Brazil requires approval from its health ministry before granting pharmaceutical patents. The European Union demands “significant clinical benefit” for certain secondary patents. And the World Health Organization says secondary patents are the #1 legal barrier delaying generic access in 68 low- and middle-income countries.

Pharma companies adapt. They file secondary patents everywhere - but only enforce them where the rules favor them. Tamiflu’s patent lasted until 2016 in the U.S. thanks to secondary protections, but generics hit the market in India in 2011.

The Business of Extending Exclusivity

This isn’t accidental. It’s a calculated strategy called Pharmaceutical Lifecycle Management (LCM). Teams start planning secondary patents 5-7 years before the primary patent expires. They file formulation patents 3-4 years out. Method-of-use patents come after the drug is already on the market.It costs $12-15 million per secondary patent application. Big pharma spends billions on this. Pfizer alone has over 14,200 active secondary patents. And it works: drugs earning over $1 billion a year are 4 times more likely to have 10+ secondary patents than drugs making less than $100 million.

But the tide is turning. The 2022 Inflation Reduction Act lets Medicare challenge certain secondary patents. The European Commission is targeting “patent thickets” as anti-competitive. Courts are becoming stricter - the 2023 Amgen v. Sanofi ruling limited how broadly antibody patents can be claimed.

Industry analysts predict that by 2027, companies will need to prove their secondary patents offer real patient benefits - not just legal loopholes - to survive regulatory and public scrutiny.

What’s Next for Secondary Patents?

The system is under pressure. Public outrage over drug prices, political action, and court rulings are making it harder to stretch exclusivity without real innovation. Generic manufacturers are getting smarter too. In 2022, they filed Paragraph IV challenges against 92% of listed secondary patents - though only 38% succeeded in court.Some companies are shifting tactics. Instead of filing dozens of weak patents, they’re focusing on fewer, stronger ones tied to actual clinical advances. Others are combining secondary patents with data exclusivity - a separate 5-12 year protection granted by regulators that doesn’t depend on patents at all.

But the core issue remains: when a drug’s original patent expires, should a company be able to lock the market for another 5, 10, or even 15 years by tweaking the packaging, timing, or dosage? Or should patients get access to affordable copies as soon as the science allows?

For now, the answer depends on where you live. In the U.S., the system favors the brands. In India, it favors patients. The rest of the world is watching - and deciding where they stand.

Are secondary patents the same as primary patents?

No. Primary patents protect the active ingredient itself - the core chemical compound. Secondary patents protect things like how the drug is formulated, how it’s taken, or what disease it treats. They’re filed after the primary patent and can extend exclusivity long after the original patent expires.

Why do generic drug makers struggle to enter the market?

Brand companies file dozens of secondary patents and list them in the FDA’s Orange Book. Generic makers must legally challenge each one, which costs $15-20 million per drug. Even if they win, lawsuits can delay entry for years. Many simply can’t afford the fight.

Do secondary patents lead to better drugs?

Sometimes. About 12% of secondary patents, according to Harvard research, lead to meaningful clinical improvements - like fewer side effects or easier dosing. But most are minor changes: switching from a capsule to a tablet, or changing the release time. These don’t improve health outcomes - they just keep prices high.

Which countries block secondary patents?

India’s patent law (Section 3(d)) explicitly blocks patents on new forms of known drugs unless they show significantly better efficacy. Brazil requires health ministry approval before granting pharmaceutical patents. The EU demands proven clinical benefit for some secondary patents. These rules help keep generic drugs affordable.

How long do secondary patents extend exclusivity?

On average, secondary patents add 4-5 years of protection for drugs with a primary chemical patent. For drugs without a strong primary patent, they can add 9-11 years. In extreme cases like Humira, secondary patents extended exclusivity for over a decade beyond the original patent.

Is the U.S. government doing anything to stop this?

Yes. The 2022 Inflation Reduction Act lets Medicare challenge certain secondary patents. The FDA and courts are also applying stricter standards. The European Commission and WHO are pushing global reforms. But change is slow - and pharma companies still spend billions fighting to keep the system intact.

11 Comments

Robert Gilmore December 27, 2025 AT 15:57

so like... the drug company just changes the pill color and calls it a new product? wow. that’s wild.

Robert Gilmore December 27, 2025 AT 18:09

they’re not just extending patents-they’re running a global monopoly scheme. The FDA, Big Pharma, and the DOJ are all in cahoots. Did you know the same lobbyists who wrote Hatch-Waxman also own shares in Pfizer? This isn’t capitalism-it’s corporate feudalism. The government is just a shell game where your insulin payments fund their yachts. And don’t get me started on the WHO’s silent complicity… they take funding from pharma too. You think India’s blocking patents? They’re the only ones not on the payroll.

Robert Gilmore December 27, 2025 AT 21:11

look, i’m not saying it’s a conspiracy… but it’s also not not a conspiracy. They patent the *idea* of a pill existing. They patent the *feeling* of swallowing it. They patent the *sound* the bottle makes when you shake it. Why? Because the system is designed to turn medicine into a luxury good. And the real tragedy? We all pay for it-with our health, our savings, our dignity. And they call it innovation. I’m not mad… i’m just disappointed. 😔

Robert Gilmore December 28, 2025 AT 02:25

Oh my god. I just realized-this is the exact same playbook as Apple’s ‘new’ iPhone release cycle. Same thing. Same energy. Same scam. You people are so naive. These companies don’t care about you. They care about quarterly earnings. And you? You’re just a walking ATM with a prescription. 🤡

Robert Gilmore December 28, 2025 AT 20:00

While I appreciate the thoroughness of this analysis, I must emphasize that the systemic inequities in pharmaceutical patent law represent a profound moral failure. The conflation of intellectual property with public health is not merely a legal issue-it is an ethical crisis. When a child in rural Bihar cannot access a life-saving medication because a corporation holds a patent on a polymorphic variant of a molecule discovered decades ago, we must ask ourselves: What kind of society permits this? The answer, I fear, is one that prioritizes profit over personhood. We owe it to the global community to reform this architecture.

Robert Gilmore December 29, 2025 AT 21:21

Let me be clear: if you’re okay with secondary patents, you’re complicit in the suffering of millions. You’re not just ‘ignorant’-you’re actively enabling corporate violence. Every time you fill a prescription at full price instead of demanding generics, you’re funding the same executives who block access in developing nations. There’s no neutrality here. Silence is compliance. And compliance is cruelty.

Robert Gilmore December 31, 2025 AT 13:33

This is textbook regulatory capture. The Orange Book is a joke. It’s not a public record-it’s a weapon. The FDA’s role is to protect public health, not to serve as a legal enforcer for pharma’s profit engine. The fact that we still allow this to happen is a national disgrace.

Robert Gilmore January 2, 2026 AT 08:31

Let’s be real: secondary patents are the pharmaceutical industry’s version of ‘product differentiation’ in the detergent aisle. ‘New and improved!’ But here, the ‘improvement’ is a 0.3-second slower dissolution rate. We’re not talking innovation-we’re talking legal arbitrage dressed up as science. This isn’t capitalism. It’s rent-seeking on steroids. And the worst part? The market doesn’t even punish them. We keep buying it. We’re the enablers.

Robert Gilmore January 4, 2026 AT 00:40

Okay, but what if… the entire pharmaceutical industry is a front for a shadow government? I mean, think about it: who controls the FDA? Who funds the clinical trials? Who writes the guidelines? Who decides what’s a ‘meaningful improvement’? It’s all the same 12 families. They’re not just extending patents-they’re extending control. They’ve turned medicine into a surveillance tool. The pills you take? They’re tracking you. The data? Sold to insurers. The side effects? Buried. The patents? Just the tip of the iceberg. Wake up.

Robert Gilmore January 5, 2026 AT 18:03

Interesting breakdown-though I’d argue the real win isn’t just legal reform, it’s cultural. We’ve normalized paying $1000 for a pill that costs $2 to make. We’ve accepted that ‘innovation’ means changing the capsule shape. We’ve stopped asking ‘why?’-and that’s the real problem. The Inflation Reduction Act is a start. But real change happens when patients stop accepting the narrative. When we demand transparency. When we stop praising ‘breakthroughs’ that are just rebranded generics. It’s not about being anti-pharma. It’s about being pro-human. 💡

Robert Gilmore January 7, 2026 AT 09:47

It is indeed a matter of considerable concern that the legal architecture of pharmaceutical exclusivity in the United States fundamentally undermines equitable access to essential medicines. The Indian jurisprudential model, as codified under Section 3(d) of the Patents Act, 1970, represents a paradigm of public health prioritization over corporate rent extraction. The decision in Novartis v. Union of India, 2013, was not merely a legal victory-it was a moral imperative upheld by the judiciary. One must observe, with profound regret, that the U.S. regulatory framework remains captive to the logic of shareholder value, wherein therapeutic efficacy is subordinated to patent longevity. The global south, in its resistance, offers not merely an alternative, but a corrective.